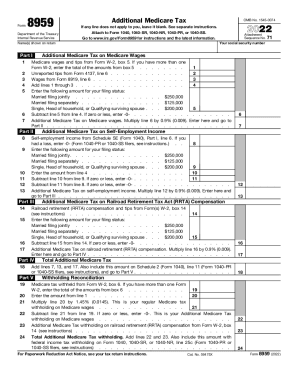

IRS 8959 2023-2024 free printable template

Get, Create, Make and Sign

How to edit form 8959 for online

IRS 8959 Form Versions

How to fill out form 8959 for 2023-2024

How to fill out form 8959

Who needs form 8959?

Video instructions and help with filling out and completing form 8959 for

Instructions and Help about 8959 sample form

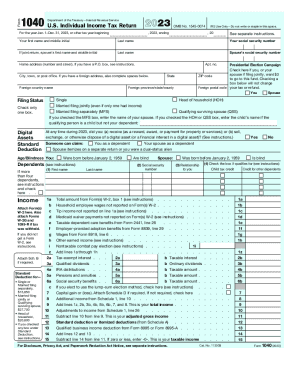

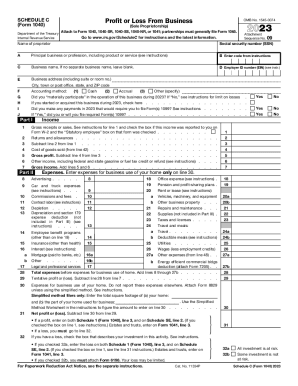

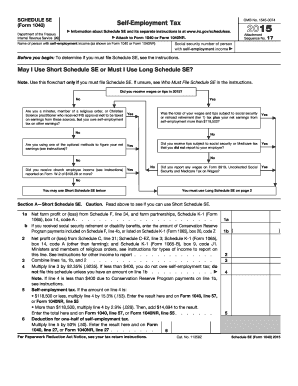

Welcome back this Thomas again for another tax reform update for the context online course this is scheduled for other taxes which basically is the section that they pulled out of the 1040 2017 version and reschedule it and renamed it schedule for other taxes which deals with line 57 to 64 so if you got the 1040 2017 version, and you go to that same line 57 to 64 till match your schedule that they get simply pulled out of the 10 or 14 so big city each section antenna for they put it out and call it a schedule and then enter one through six so of the taxes is what this deal with self-employment live 57 and record of Social Security and Medicare tips form 4137 for people working the tip industry waiters or waitresses and bartenders and people know how to get tips which is included only w-2s for people who get a w-2 who considered employees box 718 every 10 funny wait early w-2 should be filled in with some type of dollar amount also 959 additional taxes on iris and qualify were kind of plans so for people call out my only 401 ks before they fit nine and a half years old they get penalized additional tax for doing that they get at a nine are at the end of the year for the money they pull down if they didn't pay it back before then that's how it normally works then comes to insurance for individual responsibilities they got a section for that longer you check for years cause a lot of people get insurance through their jobs or do the government or whoever they get insurance through really no matter at all they got insurance that's how they go and so a lot of things that other taxes deal with him, it's the same section of the 10th wave line of the 2017 version that they get simply called out and renamed is scheduled for and so again another video I've gone to more detail with each of these schedules as they relate to that you're going to receive the goalie basic and contact program that you have access to for 12 months of your it's your leisure to learn this stuff at your own pace and I see in the next video

Fill 8959 additional : Try Risk Free

People Also Ask about form 8959 for

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your form 8959 for 2023-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.